LS-ATO

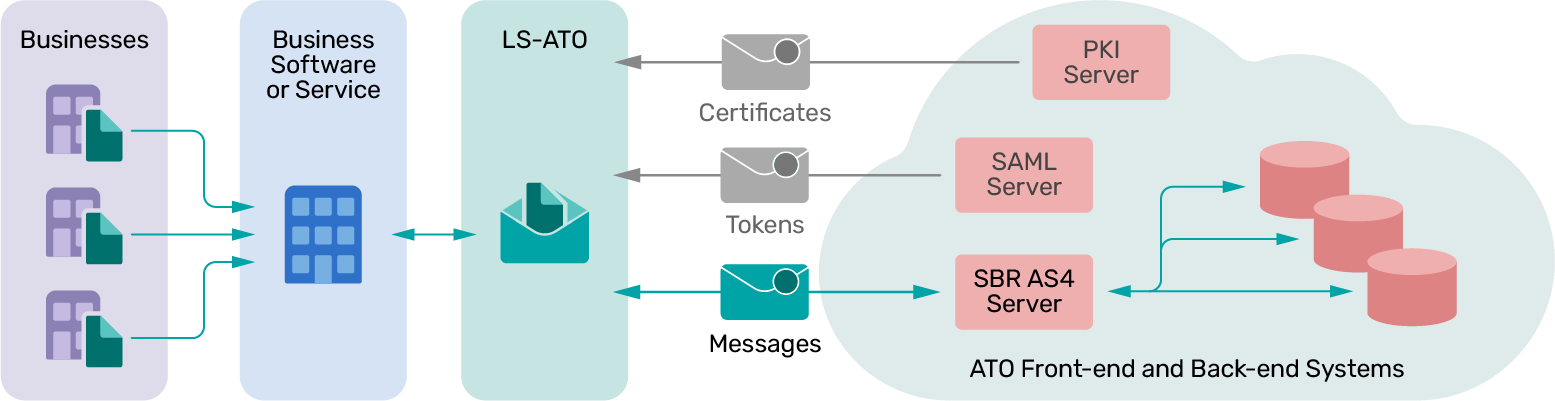

LS-ATO makes it easy for your business software or cloud service to send and receive documents to/from the Australian Taxation Office’s (ATO) Standard Business Reporting (SBR) system.

Custom-built to handle all the ATO's messaging and security requirements, LS-ATO has been widely integrated into accounting, tax, payroll, superannuation, recruitment, and many other business management applications.

Overview

LS-ATO is the smallest, fastest and simplest ebMS3/AS4 client that interacts with the ATO, and is up to 10x faster, 20x smaller and 50x more efficient than most other AS4 clients.

To make integration easy, LS-ATO has a simple interface to hide all the complexities of SBR. It also automates many tedious aspects of SBR such as assembly/disassembly of batch/bulk/collect payloads.

Though LS-ATO is small and simple, under-the-covers, it packs considerable functionally to support all of the ATO’s requirements and ensure that operations are fast, reliable, scalable and secure.

LS-ATO has been widely integrated into accounting, taxation, payroll, superannuation, and other business systems, including both desktop applications and cloud services.

Why LS-ATO?

Your ebMS3/AS4 client needs to be extended or purpose-built to meet the ATO's additional requirements, which takes time, effort, and money.

These extra requirements include the ATO's custom services, special interactions, unusual file formats, protocol extensions, and the use of a SAML token with AS4.

LS-ATO is a custom-built ebMS3/AS4 client specifically designed to handle all the requirements of the ATO's SBR system, and work as a simple drop-in component to get you up and running fast.

It handles all the (low-level) ATO messaging and security requirements so that your business application can focus on managing the (high-level) information that needs to be sent to, or received from, the ATO.

Small and Fast

Written in C, LS-ATO is up to 10x faster, 20x smaller and 50x more efficient than most other AS4 clients.

Simple to setup

1 exe, 1 config file

Complicated to setup

Over 50 files and libraries

Typically > 1 GB

Simple to setup

Complicated to setup

1 exe, 1 config file

Over 50 files and libraries

Typically > 1 GB

Simple to setup

Complicated to setup

1 exe, 1 config file

Over 50 files and libraries

Typically > 1 GB

LS-ATO is a single all-inclusive executable of just 6 MB in size, and doesn’t require any other packages, nor special privileges to run. This makes it highly portable and easy to distribute with desktop packages.

In cloud environments, LS-ATO’s tiny CPU/memory usage means that it hardly costs anything to run. Savings can be significant if the cloud service dynamically scales up with many instances of LS-ATO to handle peak loads.

Easy Integration

LS-ATO has a simple command line interface which is easily called from any language or script. With versions available for both Windows and Linux, LS-ATO is easily deployed as it runs standalone without any special privileges or dependencies.

Simple interface

Applications just need to call LS-ATO with a set of simple command line arguments. This hides all the complexities of SBR. Options can be collected together into a command file for easy testing of different ATO services.

Callable from any language

LS-ATO can be called from any language (e.g. C#/.NET, PHP, Java, NodeJS, Python, Ruby on Rails, Go, Delphi, 4GLs) or any type of script (e.g. batch files, shell scripts, macros). For convenience, common configuration options can be saved in a configuration file.

Easily Deployed

LS-ATO is a single standalone executable that easily fits into operational systems. It is tiny in size (only 6 MB) and runs without any special privileges or dependencies. It uses hardly any memory or CPU, so can run on any entry-level Linux or Windows machine.

Rich in Features

LS-ATO is rich in features. This includes full support all of ATO's actions, services, file formats, special flags, interactions and extensions. In addition, LS-ATO has native support of the ATO’s endpoints, M2M keystore and automatic certificate renewal.

All ATO services

LS-ATO makes it easy for you to interact with the ATO - supporting all of the ATO's tax, payroll, superannuation and other services (e.g. AS, CLNTCOMM, CTR, CUREL, FBT, IITR, LDG, LDGLST, PAYEVNT, SMSFAR, TPAR), as well as all of their associated actions (e.g. Adjust, Cancel, Get, List, Lodge, Remove, Search, Submit, Update, Validate).

All ATO customisations

All of the ATO’s additional requirements are supported by LS-ATO. This includes security (e.g. SAML, digital signatures, the ATO’s M2M keystore), special flags (e.g. ELS, SSIDs, SSPs), file formats (e.g. batch/bulk requests, channel/validation reports, business responses) and message types (single-sync, batch, bulk, batch-of-bulk and collect).

All ATO interactions

LS-ATO has many built-in features to automate some of the more difficult interactions with the ATO. For example, SAML handling is automatic so that the application doesn’t even need to be aware that SAML tokens are being fetched and refreshed as required. Other powerful options include automatic polling (push/pulls), automatic assembly/disassembly of batch/bulk file formats, and automatic renewal of the M2M keystore before it expires.

Trusted and Reliable

Nearly all tax, accounting, payroll, superannuation, and other financial and data management applications are business-critical. These systems depend on the robustness, scalability and reliability of LS-ATO in production environments.

Proven in production

Hundreds of organisations, from small to large, rely on LS-ATO. As an embedded component in desktop products or cloud services, LS-ATO has a proven track record of running flawlessly in production environments for many years.

Mature

Network administrators value the many operational features built-in to LS-ATO. These features include network proxy support, tuneable logging and tracing, detailed diagnostics and application actionable return codes.

Flexible deployment

LS-ATO has been deployed in a diverse set of environments. These include Windows and Linux desktops, Virtual Machines, Containers and most of the major cloud infrastructures (e.g. AWS, Azure, Google Cloud).

Pricing

There are no restrictions on testing and the free download package includes comprehensive documentation, and easy-to-run example ATO conformance tests.

Testing is free and can be done on any modern computer. Full documentation and sample tests can be found in the download package. Tests use the ATO’s External Testing Vendor Environment (ETVE).

Once you go into production, pricing is based on simple and cost-effective monthly tiers. Note that only successful pushes to the ATO are counted, and so this doesn’t include errors, pull requests, SAML requests or other housekeeping messages such as certificate renewals.

Prices start from $50/month. This is an all-inclusive price just based on the number of successful submissions/month. This covers all capabilities of LS-ATO and there are no extra costs for support, maintenance, data size, number of instances of LS-ATO, number of users, types of services or any other hidden charges.